I recently came across a fantastic read on DHFL Pramerica mutual fund website and it can't be explained any better than that why you need a financial advisor. Read on to know how a financial advisor acts as an experienced coach, dietician, mentor, vigilant instructor, friend, parent, architect, teacher, doctor or partner.

Reason #1: Like an experienced coach, a financial advisor gives professional advice based on your needs. Like a coach who brings in his professional experience to help players, a financial advisor brings with him, the pool of professional knowledge and expertise to help you set and achieve specific financial goals.

Reason #2: Like a mentor, a financial advisor helps you set measurable goals who guides you towards the right career path. A financial advisor helps you not only to set the overall financial target but also to break-up the target into smaller measurable goals. Therefore by taking a step-by-step approach the financial planner can measure your progress and take corrective action when necessary.

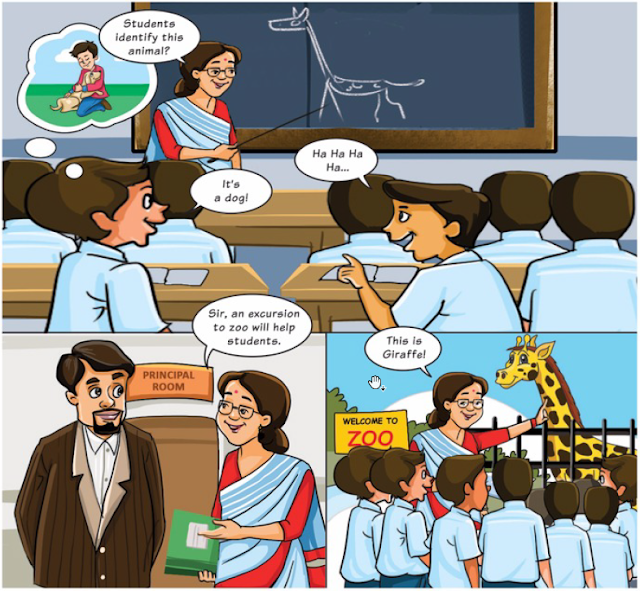

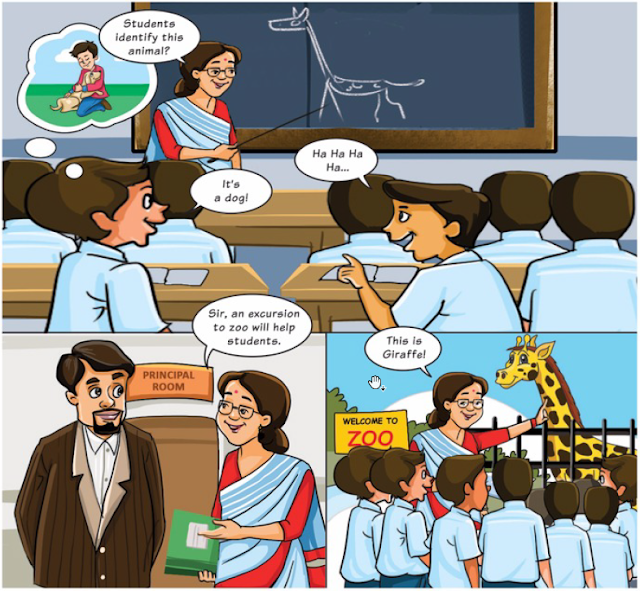

Reason 3: Like a good teacher, a financial advisor helps you understand various financial instruments. Just like a good teacher helps students understand various concepts, a financial advisor helps you better understand various financial instruments and their relevance to your goals. Sometimes you may choose the wrong financial product due to a lack of understanding of the subject, here a financial advisor can correct you and suggest the appropriate product.

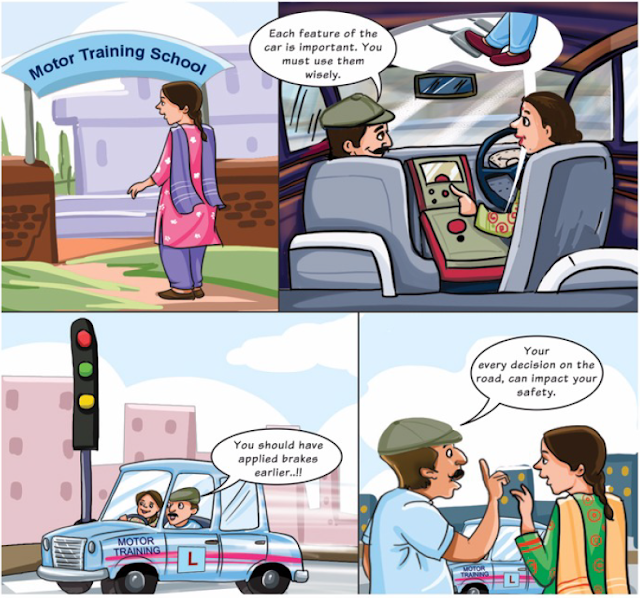

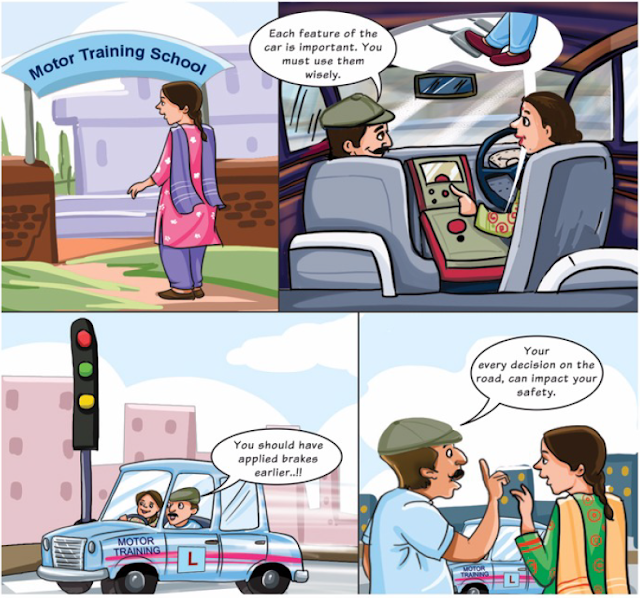

Reason 4: Like a vigilant instructor, a financial advisor highlights the effect each financial decision has on your overall financial goals. Just as a driving instructor will highlight to you mistakes that can cost you your life, a financial advisor guides you in making your financial decisions after studying the impact they can have on your various goals. You must, therefore, share every detail of your current financial situation, so that he/she can advise you correctly.

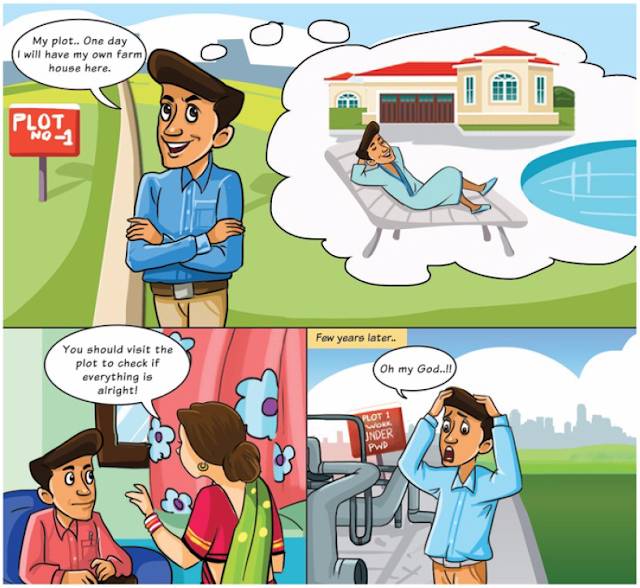

Reason 5: Like a well-meaning friend, a financial advisor reminds you to re-evaluate your financial situation periodically Just as you rely on your friend for timely advice, you can rely on your financial advisor to track, review and re-evaluate your investments periodically so that you avoid nasty surprises later. Financial planning is a dynamic process and a financial advisor keeps regular track of your investments and revises your financial strategy if there are changes in lifestyle or circumstances.

Reason 6: Like a parent, a financial advisor encourages you to start planning as soon as you can. Just as a parent constantly reminds a child about the importance of starting studies early, a financial advisor will advise you to start planning for your goals and start investing at the earliest so that you have the benefit of time to achieve your financial goals.

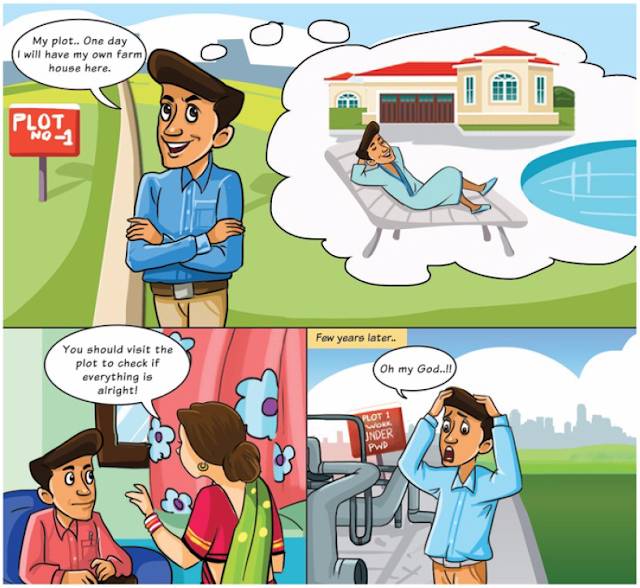

Reason 7: Like a seasoned architect, a financial advisor will draw up a financial plan which is practically achievable There are many beautiful plans that an architect may have, but your house plan will be based on how much you can afford. In the same manner, a financial advisor will give broad performance measures that can be expected from each asset class, and will correct you if your expectations are unrealistic.

Reason 8: Like a good dietician, a financial advisor recommends a plan that empowers you to take charge of your financial health Just like a good dietician advises you on the best food options that complement your body type, a financial advisor helps you chalk out your investment strategy, offering options that suit your requirement but leaves the final decision to you. This will make you realize that it is actually you who is in charge of your hard-earned money.

Reason 9: Like your family doctor, a financial advisor keeps your interest in mind at all time. Your family doctor keeps your health in mind while treating your illness, similarly, a financial advisor also gives priority to your interest and not his own. An agent may push products which will fetch him more commission but a financial advisor recommends such instruments that will help you realize your short-term and long-term financial goals while keeping your risk profile in mind.

Reason 10: Like a supportive spouse, a financial advisor frees up your time so that you can concentrate on other important things Just like a supportive spouse takes care of household work, a financial advisor takes care of your financial planning needs. In the midst of various daily engagements, you may not get enough time to do the proper homework before making an informed investment decision. A financial advisor does this on your behalf.

Reason #1: Like an experienced coach, a financial advisor gives professional advice based on your needs. Like a coach who brings in his professional experience to help players, a financial advisor brings with him, the pool of professional knowledge and expertise to help you set and achieve specific financial goals.

Reason #2: Like a mentor, a financial advisor helps you set measurable goals who guides you towards the right career path. A financial advisor helps you not only to set the overall financial target but also to break-up the target into smaller measurable goals. Therefore by taking a step-by-step approach the financial planner can measure your progress and take corrective action when necessary.

Reason 3: Like a good teacher, a financial advisor helps you understand various financial instruments. Just like a good teacher helps students understand various concepts, a financial advisor helps you better understand various financial instruments and their relevance to your goals. Sometimes you may choose the wrong financial product due to a lack of understanding of the subject, here a financial advisor can correct you and suggest the appropriate product.

Reason 4: Like a vigilant instructor, a financial advisor highlights the effect each financial decision has on your overall financial goals. Just as a driving instructor will highlight to you mistakes that can cost you your life, a financial advisor guides you in making your financial decisions after studying the impact they can have on your various goals. You must, therefore, share every detail of your current financial situation, so that he/she can advise you correctly.

Reason 5: Like a well-meaning friend, a financial advisor reminds you to re-evaluate your financial situation periodically Just as you rely on your friend for timely advice, you can rely on your financial advisor to track, review and re-evaluate your investments periodically so that you avoid nasty surprises later. Financial planning is a dynamic process and a financial advisor keeps regular track of your investments and revises your financial strategy if there are changes in lifestyle or circumstances.

Reason 6: Like a parent, a financial advisor encourages you to start planning as soon as you can. Just as a parent constantly reminds a child about the importance of starting studies early, a financial advisor will advise you to start planning for your goals and start investing at the earliest so that you have the benefit of time to achieve your financial goals.

Reason 7: Like a seasoned architect, a financial advisor will draw up a financial plan which is practically achievable There are many beautiful plans that an architect may have, but your house plan will be based on how much you can afford. In the same manner, a financial advisor will give broad performance measures that can be expected from each asset class, and will correct you if your expectations are unrealistic.

Reason 8: Like a good dietician, a financial advisor recommends a plan that empowers you to take charge of your financial health Just like a good dietician advises you on the best food options that complement your body type, a financial advisor helps you chalk out your investment strategy, offering options that suit your requirement but leaves the final decision to you. This will make you realize that it is actually you who is in charge of your hard-earned money.

Reason 9: Like your family doctor, a financial advisor keeps your interest in mind at all time. Your family doctor keeps your health in mind while treating your illness, similarly, a financial advisor also gives priority to your interest and not his own. An agent may push products which will fetch him more commission but a financial advisor recommends such instruments that will help you realize your short-term and long-term financial goals while keeping your risk profile in mind.

Reason 10: Like a supportive spouse, a financial advisor frees up your time so that you can concentrate on other important things Just like a supportive spouse takes care of household work, a financial advisor takes care of your financial planning needs. In the midst of various daily engagements, you may not get enough time to do the proper homework before making an informed investment decision. A financial advisor does this on your behalf.

No comments:

Post a Comment